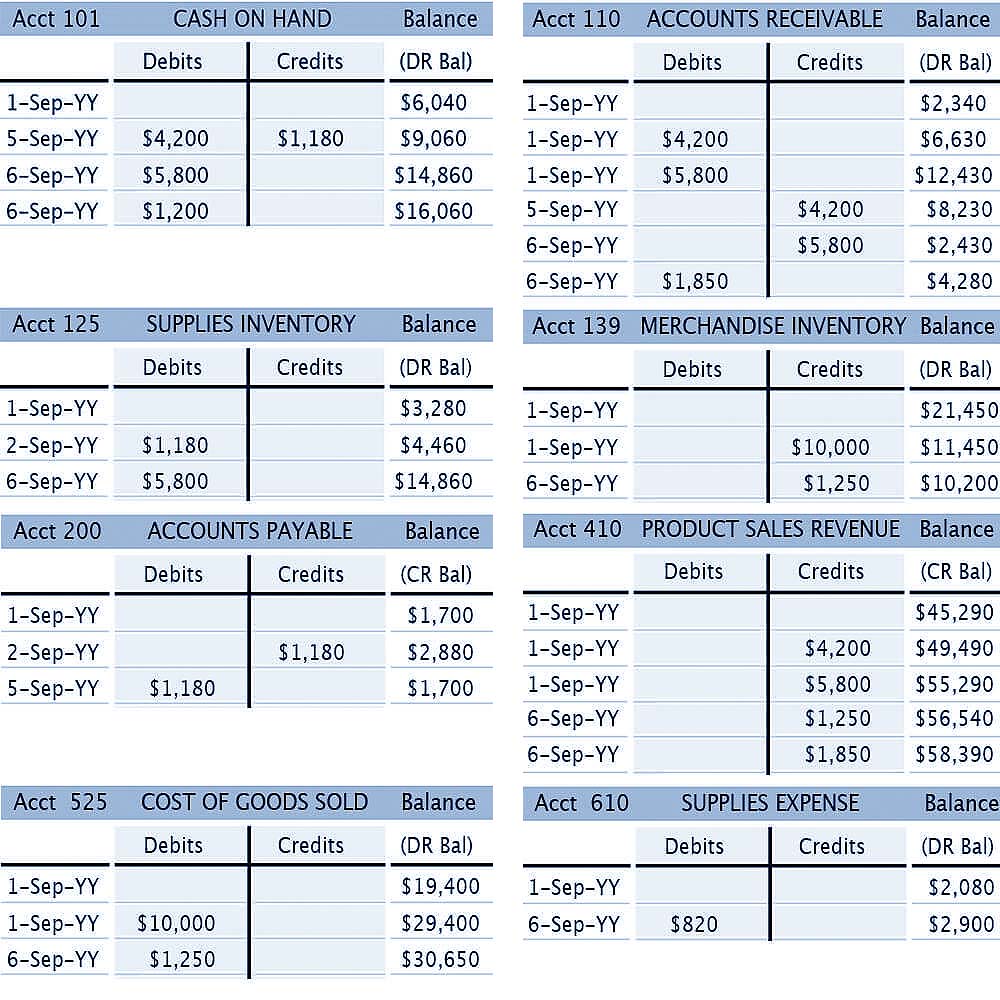

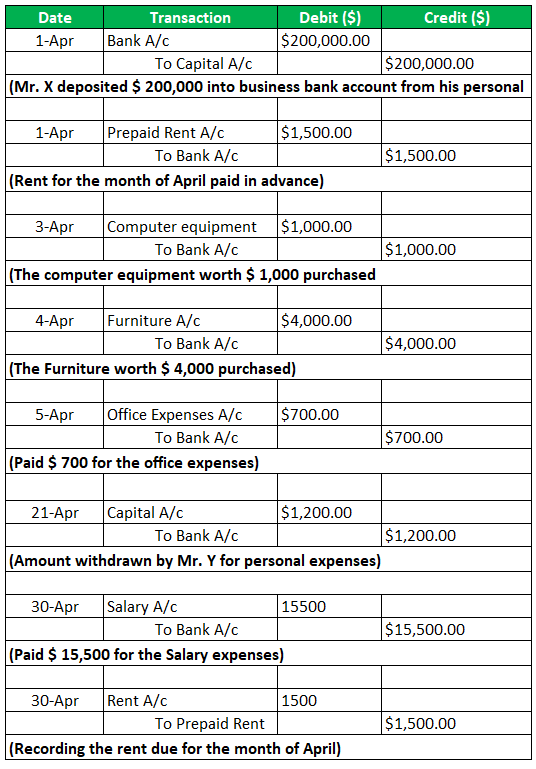

It provided an internal control over record keeping. Since bookkeeping using ledgers is older than the United States, it was an ingenious way to double-check without having to actually do everything twice. Since the total of the accounts receivable subsidiary ledger must agree with the balance shown in the accounts receivable general ledger account, the system helps us find mistakes. The purpose of keeping subsidiary ledgers is for accuracy and efficiency. If the numbers did not match, we would have to find out where the error was and then fix it. If you check Accounts Receivable in the general ledger, you see the balance is $2,989, and the balance in Accounts Payable is $6,071. Note that each account used by the company has its own account section in the general ledger. 2 transaction) would also be posted to the general ledger. The payment arrangement had credit terms the invoice was paid within the time allowed, and the discount was taken.Īt the end of the month, each of the previous journal totals are posted to the appropriate account in the general ledger, and any individual account postings, such as to Rent Expense (Jan. Paid for inventory purchased earlier on account. Payment is made for inventory purchased on account in a prior month. Since the company is using the perpetual method, a credit is made to Inventory.Īn adjusting entry is made to recognize insurance expense for the current month that had previously been prepaid. The company returns merchandise (inventory) previously purchased.

The payment was received within the discount period. 8 with credit terms if paid within the discount period. The company received payment on goods that were sold on Jan. The company received payment from PB&J thus, a cash receipt is recorded. Then prepare a schedule of accounts receivable and a schedule of accounts payable. Record all transactions using the sales journal, purchases journal, cash receipts journal, cash disbursements journal, and the general journal and post to the accounts receivable and accounts payable subsidiary ledgers. Recognized that half of the Prepaid Insurance has been consumed Recorded cash sales for the month of $3,408 (Note: COGS is $1,704) Returned $100 of merchandise to Dow John, relating to Purchase Order #72

HOW TO DO A LEDGER T ACCOUNT FULL

Received full payment from Black & White, Inc., Invoice #235īought merchandise from Dow John, $525.00 payable in 30 days, Purchase Order #72 Issued check #632 to pay BSA in full, PO 71. Issued check #63 for telephone bill received today, $72.00 Sold goods on credit to Black & White Inc.

on credit, Invoice #234 (Note: COGS is $164)īought goods from BSA for $4,300.00, Purchase Order #71, terms: 2/10, net/30 Issued check #630 to D & D in payment for December purchase on credit of $736.00 Received check from PB&J in payment for December sale on credit, $915.00

Issued check #629 for January store rent: $350.00 Use the perpetual inventory method and the gross method of dealing with sales terms.įirst, enter these transactions manually by creating the relevant journals and subsidiary ledgers. Beginning account balances are shown below. Also post to the subsidiary ledgers provided. in the special journals and post to the general ledger provided. Record the following transactions for Store Inc. Now that you have seen four special journals and two special ledgers, it is time to put all the pieces together. Accounting Information Systems 41 Prepare a Subsidiary Ledger

0 kommentar(er)

0 kommentar(er)